Summary

Summary

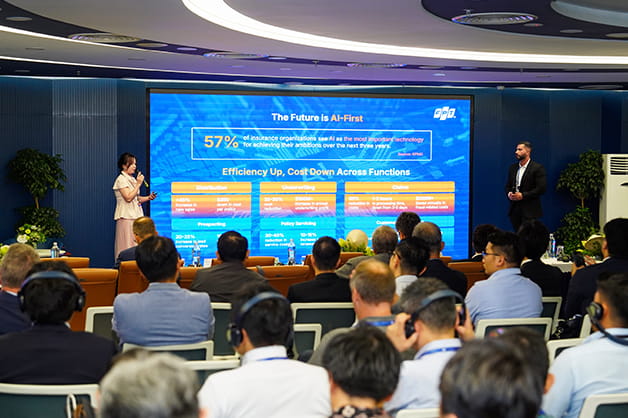

The keynote explores how AI is transforming the insurance industry by addressing inefficiencies in underwriting and claims processing.

Manual tasks and delays lead to profit leaks, churn, and lost customer loyalty. AI adoption enables significant improvements across functions—reducing costs, accelerating processing times, and enhancing fraud detection. Key benefits include a 50% reduction in claims processing time, $200M+ saved annually in fraud-related costs, and up to 45% growth in new sales.

Regional trends highlight APAC’s digital-first approach, EU’s focus on governance, and the US’s use of GenAI in service automation. FPT Software, in partnership with Microsoft and Davies, delivers AI-first solutions through its global delivery model and proprietary platforms like iSuite. Success stories showcase full agentic flow implementations and rapid delivery momentum.

Looking ahead, AI will continue to modernize adjudication, submission, and payment processes, driving client value and a more human customer experience.

Key Takeaways

AI Is Solving Critical Inefficiencies

In the insurance industry, especially in underwriting and claims, where manual processes lead to delays, profit leaks, and customer churn

AI Adoption Drives Measurable Impact

Including 50% reduction in claims processing time, $200M+ saved annually in fraud-related costs and significant improvement in sales, lead conversion and customer retention.

Global Trends Show Regional Focus Areas

APAC leads in digital-first adoption, the EU emphasizes governance and explainability, while the US is advancing GenAI for service automation.

FPT Software Is a Key Enabler

FPT Software drives the AI-first insurance future with 20+ years of BFSI expertise, global delivery and strategic partnership to deliver scalable, trusted and rapid AI solutions

Explore More Insights

Stay updated with FPT Software's AI-led insights and success stories, as well as latest thought-leadership materials.

Discover more